Contents

It is often used by traders as a way to gauge activity around a particular stock and to find potential entry and exit points. In this guide, we’ll explain what time and sales is and how… Institutional traders often use VWAP to determine when to trade so that they move the price of an asset as little as possible. So, prices tend to move back towards the VWAP when institutional traders are active. In the absence of other activity, you could buy when the price is below the VWAP or sell when the price is above the VWAP.

.jpeg)

However, the exponential moving average is calculated to give more weight to current trends, whereas the SMA finds the average using equally weighted data. For example, there are trend indicators that traders use in their trend-following strategies. At DailyForex, we’re out to prove that free Forex signals can be just as trustworthy as expensive signal subscriptions. Our reliable Forex signals will provide you with expert advice about when to buy and sell the major currency pairs without costing you a penny. If you’re looking for daily signals, we recommend that you peruse our Forex trading signals reviews for a look at some of the best professional signals providers. Technical analysis is the reading of market sentiment via the use of graph patterns and signals.

The signal line crossover is the most common signal of the MACD. It occurs when the MACD line crosses above or below the signal line. A bullish signal line crossover can be observed when the MACD line crosses above the signal line.

And vice-versa – if the bands are close to each other, the volatility is lower. Bollinger Bands is one of the most preferred indicators in the toolbox of traders interested in small and continuous gains. It is the most popular volatility-measuring indicator and one of the most complete ones. Many traders often use the indicator also to spot potential price reversals. When the price makes a lower low, but the stochastic makes a higher low, the result is a bullish divergence. On the other hand, if the price hits a higher high but the stochastic makes a lower high, we have a bearish divergence.

STOCK MARKET SIGNALS

When using the RSI indicator, day traders look for convergences and divergences. If the indicator’s highs and lows move in the same direction with the price trend, then a convergence occurs. In that case, the trader knows the trend is strong and likely to continue.

The official and most widely used levels are 23.6%, 38.2%, 61.8%, and 78.6%. It is responsible for the majority of the indicator’s movements. The longer MACD line is a 26-day EMA, and it is slower to react to price changes. The OBV is also used to signal when institutional and retail investors are present on the market and distinguish interactive brokers reputation the volume generated by either group. Large-scale investors use the VWAP to time moments to get in and out of a trade with as little effect on the market as possible. Once the PAC is installed on your machine, you will be able to open any chart you like, decide what time frame you like to view and apply these indicators.

We are registered as trading signals provider with the Federal Financial Supervisory Authority of Germany . VWAP is also used to determine support and resistance levels throughout the day. When in doubt, remember that every trader uses kraken legit different indicators. It’s up to you to find the ones that are most effective for your trading strategy and that help rather than hinder your trading. However, it’s important that you not use indicators just because they’re available.

Relative Strength Index – RSI

Thestochastic oscillatoris an indicator that measures the current price relative to the price range over a number of periods. Plotted between zero and 100, the idea is that, when the trend is up, the price should be making new highs. If the A/D starts falling while the price is rising, this signals that the trend is in trouble and could reverse. Similarly, if the price is trending lower and A/D starts rising, that could signal higher prices to come. Too many inputs would introduce complexity requiring more time than a trader has to offer.

.jpeg)

Also, we are regulated by CySEC, the Seychelles Financial Services Authority , the Financial Sector Conduct Authority , and the ADGM Financial Services Regulatory Authority . With any trade or investment, you will come across risks, and Forex is no different. The main participants of the Forex market are large international banks spread over the four major centres worldwide. Because there is no central location, individuals can trade 24 hours of the day, excluding weekends. Still, using these tools, can help you become a better trader. All you need to do is to practice and see the best way to approach them.

When trading currency pairs, a forex signal system creates a buy or sell decision based on technical analysis, charting tools, or news events. Fortunately, traders nowadays can take advantage of How blind people code hundreds of different indicators. From decades-old and widely-spread ones to custom setups – there are technical trading tools for every style, level of understanding, and investment objectives.

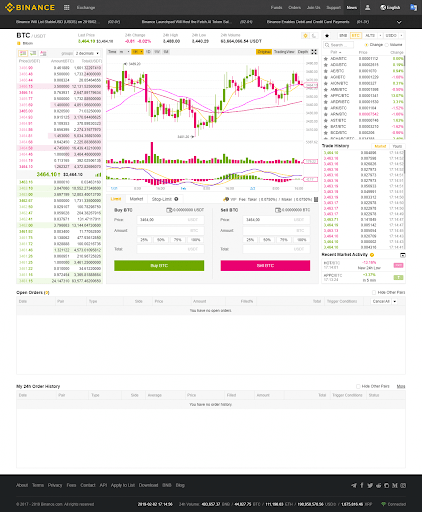

Trade Signals & Analysis for Binance Futures, Forex & Tradingview Algos

I am usually more conservate in trading, and with the trading signals, I can filter which trades are more suitable for my style and trade with them. I enjoy the fact that the trading signals have started to diversify into cryptocurrency. You really have to put in effort to learn what the terms, jargons are and the trading strategies first. If you just trade blindly based on the signals, you will have a hard time as your results will be 50-50. Our long term trading signals are an important tool that can help you understand in a more in-depth manner the market and the macroeconomic factors that move them. The band formed by these calculations can be used to indicate overbought or oversold levels, and it can inform a trader as to a trending price envelope.

- All three lines work together to show the direction of the trend as well as the momentum of the trend.

- There are several types of services that provide you with Forex signals.

- Consider the overall pricetrendwhen using overbought and oversold levels.

- I kept reading and learning, and occasionally asking Spencer about some questions which puzzled me.

Conversely, excessive bearishness can lead to market bottoms. Time will tell if my inherent skill will support success in trading. First impressions lead me to be confident that my forex investment entry into the world of trading will hit the target. Candlestick pattern recognition systems can help you identify candlestick patterns of your choice automatically and highlight the identified patterns on price charts. This website is using a security service to protect itself from online attacks.

The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Having seen every type of market condition allows us to consistently identify accurate, reliable and trustworthy trade ideas. We provide a range of resources and information that will help you trade more efficiently and become more profitable. Learn about the benefits of trading Forex, which general rules to apply and which mindset to have, to help you trade more efficiently and profitable.

When a stock is in a downtrend, the RSI will typically hold below 70 and frequently reach 30 or below. Looking at which side of zero the indicator is on aids in determining which signals to follow. For example, if the indicator is above zero, watch for the MACD to cross above the signal line to buy. If the MACD is below zero, the MACD crossing below the signal line may provide the signal for a possibleshort trade. Theaverage directional index is a trend indicator used to measure the strength and momentum of a trend.

Like most Forex strategies, it requires a lot of time to invest and understand fully, including the technical analysis and Forex indicators. The MACD technical indicator is also an oscillator used to trade trends. It measures the characteristics of a trend such as its direction, rate of change and magnitude. The MACD indicator is shown on a Forex chart as two lines, the MACD and the signal line, and a histogram or bars. It will fluctuate above and below the centreline or zero line as the moving averages show a convergence. It is when the distance between the EMAs gets closer, and the bar becomes smaller.

Best Indicators for Day Trading

Over time, day trading has established itself as the most popular and widely-preferred form of trading activity. Below are some of the characteristic features of reliable day trading software. The market facilitation index is an indicator that analyzes and visualizes momentum and price strength. The MFI is a confirmation indicator that analyzes buying and selling pressure by looking at price movements and whether volume is falling or rising.

Forex signals do not usually tell you how much to risk per trade as a rule, so that is something that you will have to decide. Forex signals can be used more intelligently as an educational tool, by analysing each signal and trying to decide why the signal provider gave the signal. The Aroon indicator is a two-lined technical indicator that is used to identify trend changes and the strength of a trend by using the time elapsed since a high or low. The average directional index helps traders see the trend direction as well as the strength of that trend.

Scalper version was designed specifically for the lower time frames (1-5min intraday scalps). This version prints in the signals directly on top of the oscillator only when the higher aggregations are aligned with the current aggregation… Secondly, the reputable trading software will have features that might not be known to every trader. Having a strong support team ensures they’ll explain the features and help you make the most out of them.

A bearish trend is signaled when the MACD line crosses below the signal line; a bullish trend is signaled when the MACD line crosses above the signal line. DTTW™ is proud to be the lead sponsor of TraderTV.LIVE™, the fastest-growing day trading channel on YouTube. Ideally, a buy signal emerges when it moves to the oversold level while a bearish signal happens when it moves to the overbought level. Therefore, a buy signal tends to emerge when the two lines make a crossover when they are below the neutral line. On the other hand, a sell signal emerges when the crossover happens when the price is above the neutral line. So, let us look at some of the best indicators to help you find entry and exit positions.